2020 Challenge and Change…

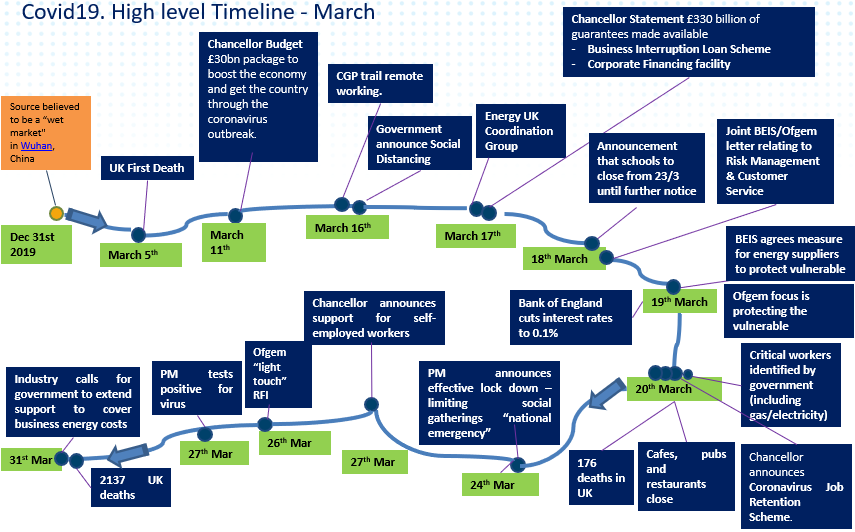

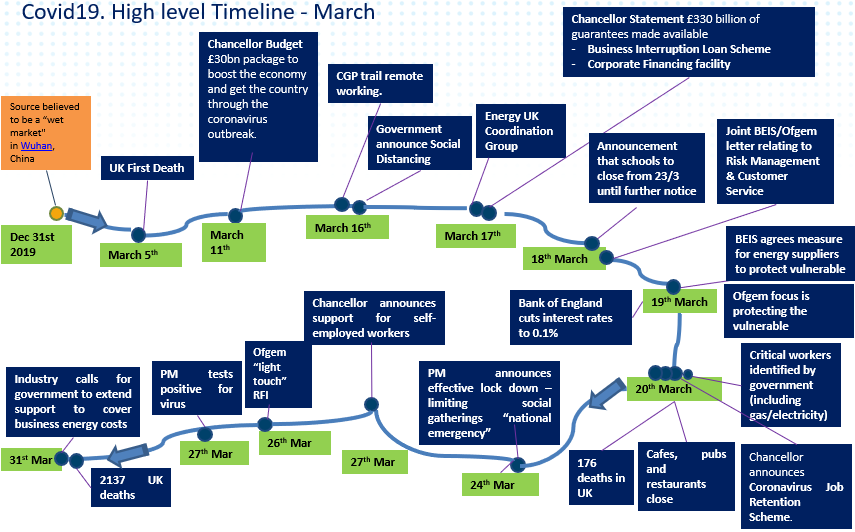

On the 2nd March 2020, when the previous newsletter was published, it was difficult to accept that Covid-19 could pose a threat to the daily lives and routines of UK citizens – after all, at that moment, there had been no recorded UK deaths. As shown in the timeline, the speed in which the virus then spread coupled with the extraordinary interventions that the government made (and continues to make to this day) was enough for even the hardiest of human characters to request a reality check.

In this issue:

- 2020 Challenge and Change…

- Faster and More Reliable Switching

- Smart Metering Roll Out – Post 2020 Framework

- Ofgem Market Monitoring

- Covid-19. The Green opportunity

- News in brief

For the non-domestic energy market, energy demand plummeted due to businesses closing their doors, whilst in the domestic market demand increased due to the number of employees either working from home or being furloughed by their employers.

Overnight supplier business continuity plans moved from a proof of concept to full production, with operational teams forced to work remotely or stood down under the furloughed scheme. With business closures non-domestic suppliers saw a wave of direct debit cancellations and customer enquiries around how best to manage their energy needs and costs during the days or months ahead. Supplier cash flows immediately became a concern. Lockdown and social distancing measures introduced meant that the ability to obtain a meter reading or investigate the condition of a metering system essentially stopped. The absence of meter readings immediately created a risk to higher industry settlement processes, as did concerns that suppliers could collapse. For a moment, it did seem like a perfect storm.

Both Ofgem and the Department for Business, Energy and Industrial Strategy (BEIS) were forced to intervene in the market, agreeing measures to support vulnerable consumers, pausing policy publications and key Programmes (a welcome relief for suppliers) and introducing an emergency framework to support regulatory flexibility. Between April and June several industry code changes and amended regulations were introduced with a common effort of providing supplier relief from burdening financial pressures given their precarious position in the energy value chain. So far, on the face of it all the suppliers which were actively trading at the beginning of the pandemic remain accounted for today.

With some sort of light at the end of the tunnel, Ofgem wrote to suppliers on the 16th June informing them of the regulatory framework which would exist from the 1st July. Essentially the honeymoon period relating to regulatory flexibility was over, with Ofgem expecting suppliers to offer a full level of service to their customers and providing support for those who are struggling to manage their energy costs. Regulatory obligations which had been temporarily relaxed (for example compliant reporting) would return to “business as usual” arrangement from the end of July.

Faster and More Reliable Switching Programme

Covid-19 impact: 6-month delay

Go live date: ~Feb-Mar 2022

On 16th April 2020, the FMRSP Delivery Group took the decision to delay the start of User Entry Process Testing (UEPT) by 6 months which had previously been planned for September 2020. Between April and June, the Programme moved into a “Supplier Relief Period” requiring minimal supplier engagement allowing them to focus resources on other priorities. With a gradual return to normality the Programme is now in the process of picking up from where it left off, with the overall objective that full Re-mobilisation will commence on 1st October. To support this target date the Programme has now moved into a “Re-mobilisation Period” in which suppliers are gradually being pulled back on board, aligning themselves to the timeline which the new Re-Mobilisation Plan will demand come the Autumn.

Smart Metering Roll Out – Post 2020 Framework

Covid-19 impact: 6-month delay

Revised date: 1st July 2021

On June 19th 2020, the Department for Business, Energy and Industrial Strategy (BEIS) published its response to its September 2019 consultation. This consultation set out the governments revised framework on which the smart meter programme would operate on beyond the 31st December 2020 deadline (the date which should have – ideally – seen smart meters installed in every home and qualifying business). Generally, BEIS has pushed ahead with its proposals which will now be implemented on 1st July 2021 (a delay of 6 months due to Covid-19). Until then the current ‘all reasonable steps’ framework will continue to apply.

From summer 2021 a new four-year smart meter roll out framework will come into effect which, for BEIS at least, will see the normalisation of smart meters. The existing ‘all reasonable steps’ approach that has brought suppliers a large degree of flexibility over the years will be dropped in favour of a more prescriptive framework which will support “market wide rollout of smart meters as soon as practicable.” As a result, each supplier will be given a legally binding target to install a minimum number of smart meters (or advanced meters in the case of non-microbusinesses) each year. Targets will be supplier specific (recognising the progress that some have already made towards the roll out) and will also be subject to a percentage tolerance. How this tolerance level will be determined will be subject to a further BEIS consultation later in the Autumn.

Targets will be based on the number of installations that the supplier completes within a year and will disregard any churn as well as exchanges of first-generation meters (SMETS1) for second generation (SMETS2). Whilst BEIS did acknowledge concerns addressed by non-domestic suppliers relating to the lack of poly-phase SMETS2 meters and the challenges associated with gas-first installs, the government fell back to its overly optimistic message highlighting that such meters would be available and challenges likely to be fully addressed come July 2021. This was echoed by Ofgem in its Open Letter to industry on 30th June 2020 noting that “many of the technical constraints will be resolved during 2020.”

Smart Metering Rollout during Covid-19

A Smart Metering Remobilisation Working Group (RWG) was assembled by BEIS at the request of energy suppliers to act as a forum to discuss the challenges faced by Covid-19 and share best working practices in relation to smart meter installations. Since May, the RWG has shared best practices relating to customer communications, as well as the health and safety techniques used by metering contractors. Such efforts have been essential to maintain a degree of traction for the Smart Metering Programme whilst recognising that consumers may be reluctant to open the door to someone outside their household.

Ofgem Market Monitoring

The past few months has seen the industry regulator impose several reporting requirements on suppliers, as well as publish various proposals on how it intends to monitor suppliers in an effort to measure the health and performance of the energy retail market.

- Covid-19 Reporting and beyond

In order to monitor and measure the impact that Covid-19 presented on the energy market, Ofgem exercised its power under Condition 5 of the supply license, and wrote to suppliers on 6th April 2020 requesting that they provided them with weekly data returns. This data (both quantitative and qualitative in its form) relates to a supplier’s customer service arrangements, its operational resourcing, and its financials. Such information will be provided up to 22nd July. From August a new monthly Covid-19 reporting requirement will be introduced, requiring customer data and financial data to be shared until at least March 2021.

- Policy consultation on the Consolidated Segmental Statement (CSS)

Currently energy suppliers who have a customer base of more than 250,000 and who are vertically aligned to their own generation, are required to provide Ofgem with a Consolidated Segmental Statement (CSS) – a Statement which is independently audited. The current customer number threshold has meant that only five energy suppliers have been required to comply with the obligation. Whilst this may have been a representative sample ten years ago, increased market competition and the need for better transparency has given Ofgem grounds to propose that the scope is widened. In its consultation closing in August, Ofgem has proposed to lower the customer threshold to 50,000 and remove the audit requirement (unless it had “significant concerns.”) Either way, the proposal would see 36 suppliers captured by the CSS obligation at a cost range between £11,000 to £274,500 depending on the supplier’s size.

- Ofgem Review of Licensing Arrangements: On-Going and Exit Arrangements

On the 25th June Ofgem published its long-waited consultation relating to supplier license arrangements. As mentioned in previous newsletters, such reforms put forward by Ofgem are to directly tackle the issue caused by suppliers unceremoniously exiting the market of which there have been 18 instances since 2018. The proposals would, on paper, provide Ofgem with early visibility of those suppliers who may be straying down a road to exit. The consultation proposes a wide variety of new principle-based license conditions, aiming to promote better risk management, place additional governance and accountability on suppliers and address exit arrangements. For monitoring purposes, suppliers who grow beyond 50,000 and 200,000 domestic customer accounts would be assessed in terms of their capability of serving such volumes. The regulator would also be able to compel suppliers to undertake an independent audit of their financial status and/or of its internal systems/procedures should they have any concerns relating to a supplier’s operation. The consultation closes in August.

Covid-19. The Green opportunity

In the previous newsletter we discussed the continuing momentum behind the governments ‘Net Zero’ target. Few would have thought that a global pandemic would only support such an initiative. Since then, by luck or design we have witnessed:

- How lockdown measures instantly saw carbon dioxide emissions fall and clean air rates increase.

- Prolonged sunshine and winds experienced during the springtime, led to excess renewable generation leading to negative prices on 66 occasions in April. Remember that suppliers paid consumers?

- The UK went coal free for 67 days (the longest since 1882).

- How global emissions are in fact expected to fall by a record 5-20% (according to a recent Committee on Climate Change Report).

As the country stares at the threat of economic disaster, pressure groups are now calling for the government to invest in the green infrastructure necessary to support long term Policy ambitions and a general economic recovery. On the 25th June 2020, the Committee on Climate Change (CCC) published its annual progress report highlighting investment priorities for the government for the months ahead. In its report the CCC noted that “the steps that the UK takes to rebuild from the COVID-19 pandemic and its economic damage can also accelerate the transition to low-carbon activities and improve our climate resilience.” Key to the success, amongst other things, will be investment in energy networks and supporting infrastructure, including hydrogen and carbon capture storage. A few days after the CCC report was published we saw the Prime Minister deliver a “Build, Build, Build” speech which referenced how the UK was innovating and leading the way on wind, solar, hydrogen and carbon capture storage technologies.

Covid-19 has brought an economic opportunity – albeit a green one. All that is needed now is the Energy White paper, which has been unavoidably delayed due to the crisis – although don’t expect this soon. Indeed, one report has stated that this would not be published until early-mid 2021 at the earliest.

News in brief:

Green Gas Levy

On 11th March 2020, the Chancellor announced that the government would be introducing a Green Gas Levy. The levy (incorporated on customer bills) will help fund the use of greener fuels and provide necessary investment to increase the Green Gas infrastructure. Workshops are underway to thrash out the design, with a general desire that it reflects the existing CCL framework.

EUs Clean Energy Package: Electricity Internal Markets Directive

The CEP: EIMD is a series of legislative acts adopted by the European Parliament and European Council in 2018 and 2019. Whilst the UK may have left the EU on 31st January 2020 (entering an 11-month transition period), the requirements of the Electricity Directive are currently being assessed by BEIS and Ofgem. Depending on the assessment, electricity retail market change could be introduced from January 2021.

Market Wide Half-Hourly Settlement

The publication of Ofgem’s full business case and impact assessment is now planned for Spring 2021.

External Resources

The energy market is complex owing to the many stakeholders and big data which it entertains. Nevertheless, the links below provide some useful visual information which may help satisfy your curiosity or be of some use if you wish to understand more. The link to the Unidentified Gas (UIG) Dashboard is still in development, although it does provide some insightful features to illustrate the levels of unidentified gas on a regional and national level. Credit should also be given to Xoserve for publishing some useful infographics which provide some practical reference points.

Gas System and Market Status (National Grid) – http://mip-prod-web.azurewebsites.net/StatusView

National Grid System Electricity Generation Status (National Grid) – http://grid.iamkate.com/

UIG Dashboard (in development) – https://www.gasanalytics.co.uk

Gas Industry Process Booklet (produced by Xoserve) – https://www.xoserve.com/media/8023/gas-industry-processes-booklet.pdf

Gas Industry Stakeholders Infographic (produced by Xoserve) –

https://www.xoserve.com/media/8025/industry-stakeholders-infographic.pdf

What do you want to see in the next issue?

If there is a particular topic or feature that you would like to see in the next newsletter then let us know by contacting your Account Manager. As usual we welcome your views and appreciate all the positive feedback that we have received to date.

My Account

My Account  My Account

My Account